The MFN Clause: Methodology and Challenges

In May 2025, the US Department of Health and Human Services (HHS), announced that they would take immediate steps to implement President Trump's Executive Order (EO) to align US pricing for all branded products withoutgeneric or biosimilar competition.

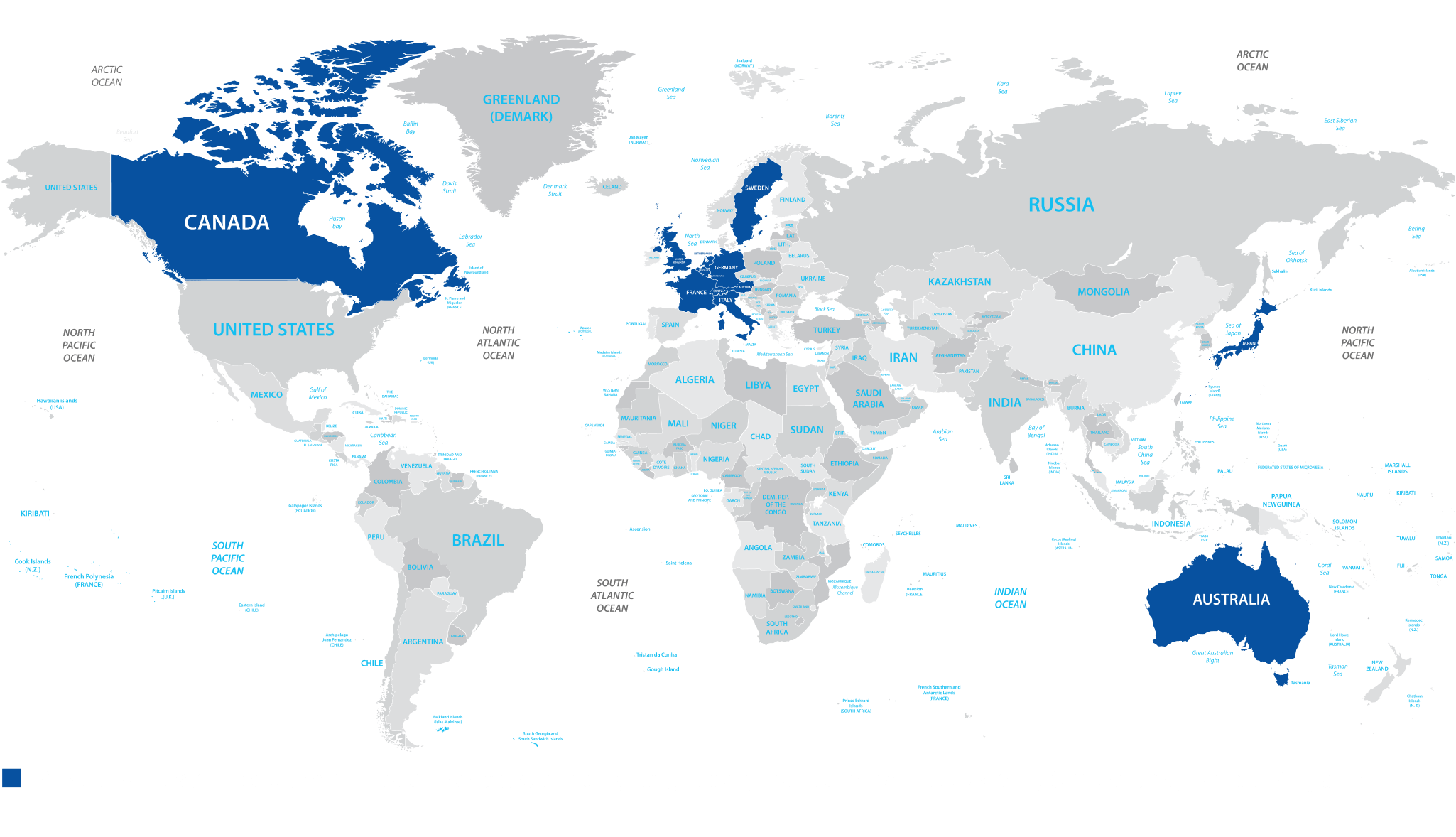

As per subsequent announcement regarding the EO proposal, the MFN target would be the lowest price available in an OECD country with a GDP per capita of at least 60% of the US GDP. Analysis of the annual GDP and consumption per capita (OECD 2023) relative to the US, highlights the flaws in this methodology as it results in a reference basket of 25 countries with very different healthcare infrastructure and financing (Table 1).

Table 1: Reference countries identified based on GDP per capita relative to the US

| Reference area | GDP per capita | Percent of US GDP |

|---|---|---|

| Luxembourg | $142,142 | 173% |

| Ireland | $125,178 | 152% |

| Norway | $100,430 | 122% |

| Switzerland | $90,230 | 110% |

| Iceland | $79,464 | 97% |

| Netherlands | $78,306 | 95% |

| Denmark | $73,725 | 90% |

| Australia | $73,401 | 89% |

| Austria | $70,487 | 86% |

| Belgium | $69,103 | 84% |

| Germany | $68,195 | 83% |

| Sweden | $66,118 | 80% |

| Canada | $64,463 | 78% |

| Finland | $61,706 | 75% |

| France | $58,330 | 71% |

| United Kingdom | $57,915 | 70% |

| Italy | $57,902 | 70% |

| Korea | $56,052 | 68% |

| New Zealand | $53,998 | 66% |

| Slovenia | $53,950 | 66% |

| Israel | $53,422 | 65% |

| Spain | $53,192 | 65% |

| Czechia | $53,149 | 65% |

| Lithuania | $50,915 | 62% |

| Japan | $49,963 | 61% |

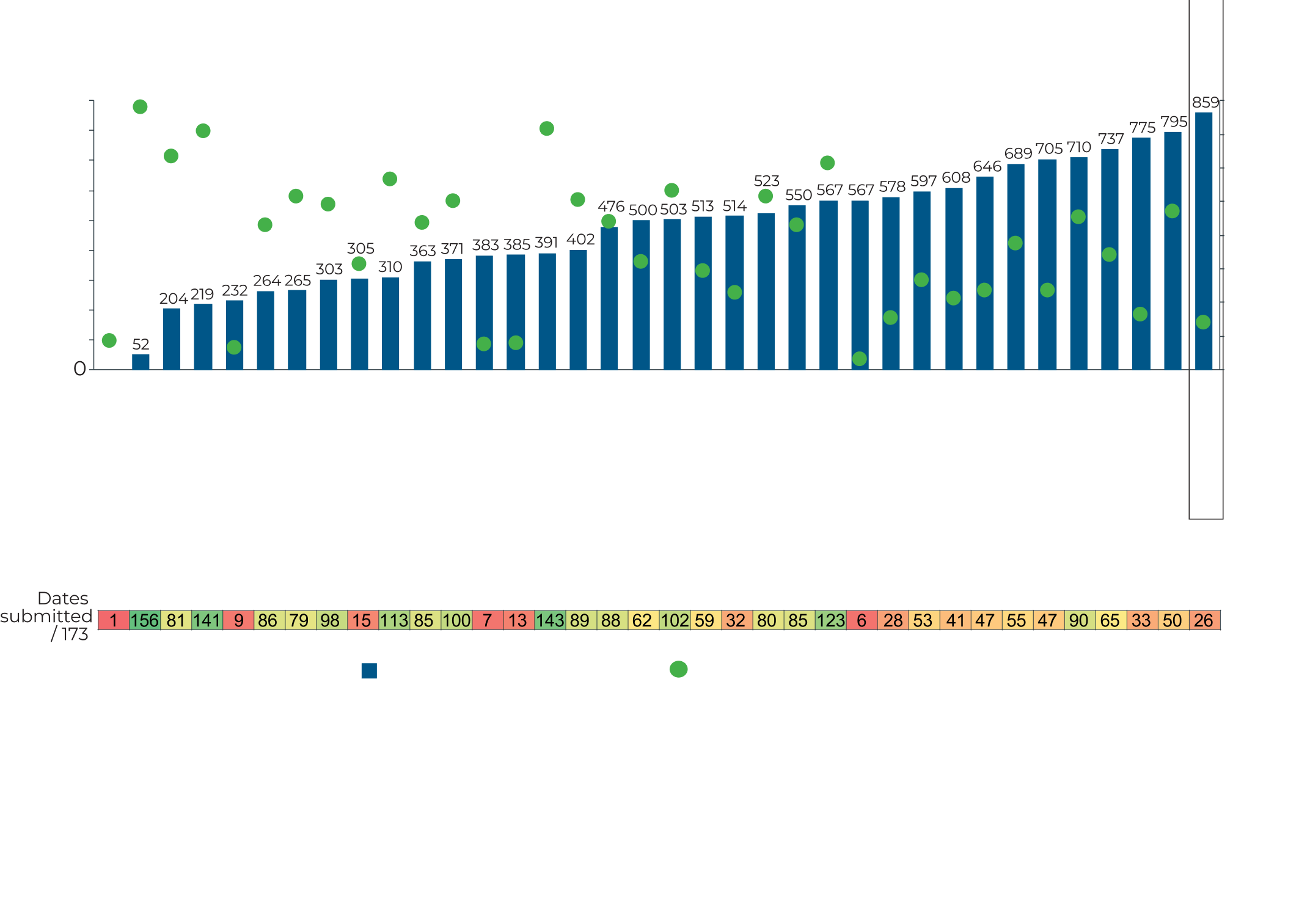

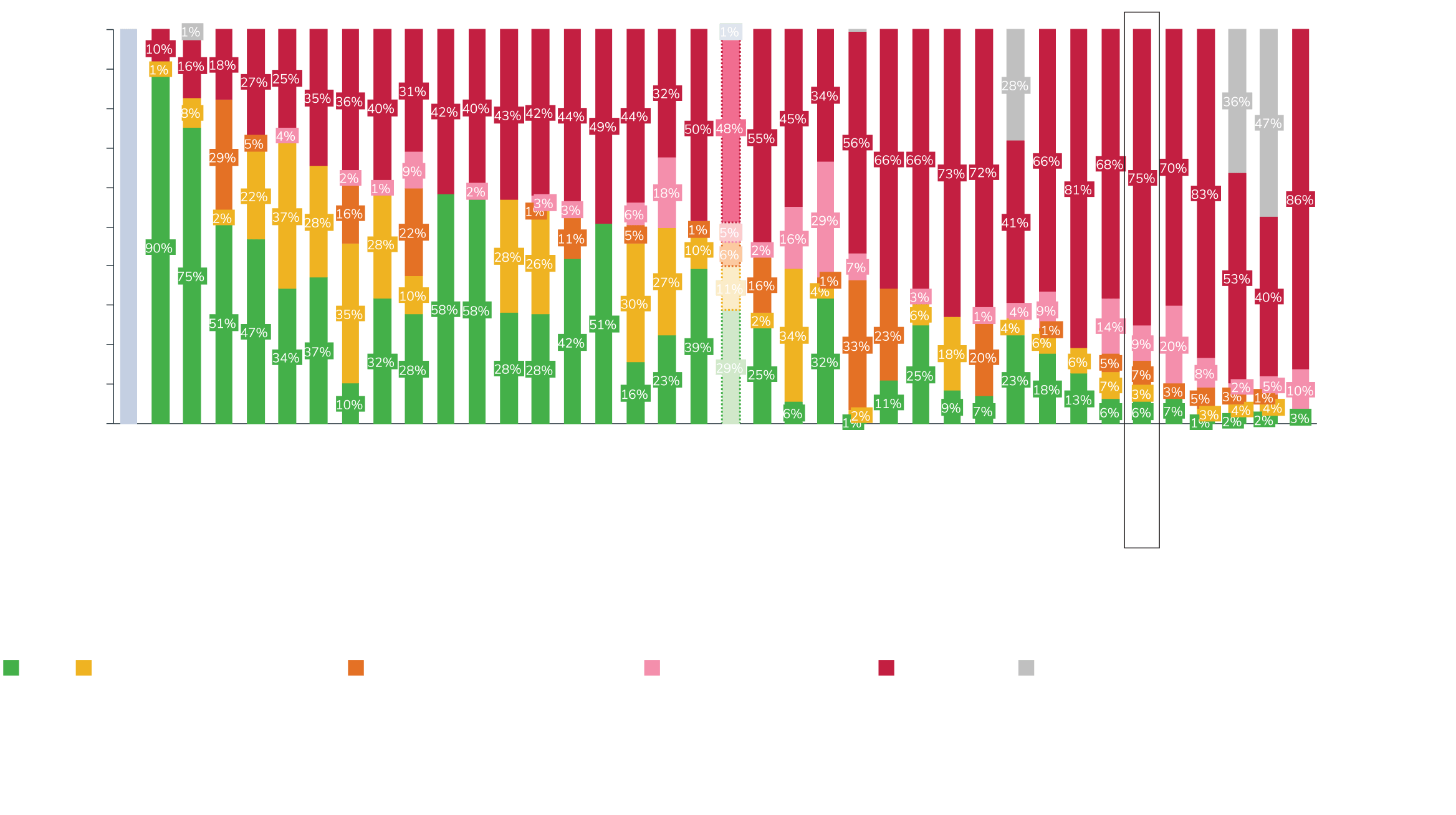

Besides the significant differences in the healthcare systems and funding mechanisms in reference countries like Slovenia to the US, this GDP method overlooks the critical aspect of delay in access to medicines in several countries. For example, in Lithuania, 75% of the products that are centrally approved by the EMA are not available (Figure 1), with median time to availability of 859 days (Figure 2).

Figure 1: Breakdown of total availability (%2020-2023)3

Figure 2: Median time to availability (2020-2023)3